Introduction

You discover your cat drinks a lot of water from the water bowl and drowns each drop with intense fervor as if it had been days since it last drank. Your initial thought is that it does not seem important. The extra water intake could indicate their thirst level is unusually high today.

The exact same water bowl drinking ritual repeats itself every day and the following day. A sudden concern enters your mind when you notice your cat drinking excessive amounts of water. Do cats generally drink that much water, or do you need to consider medical problems?

Like all creatures, cats require hydration through their daily activities yet abnormal thirst which medical professionals call polydipsia normally indicates an underlying health issue. Cats cannot ignore such symptoms.

Many possible reasons exist for increased water consumption among cats which might necessitate immediate medical care. Kidney problems along with dietary changes are among the causes.

In this article, we will examine standard water consumption levels and medical and non-medical thirst reasons alongside proper reactions when your cat exhibits water-drinking behavior changes.

Normal Water Intake in Cats

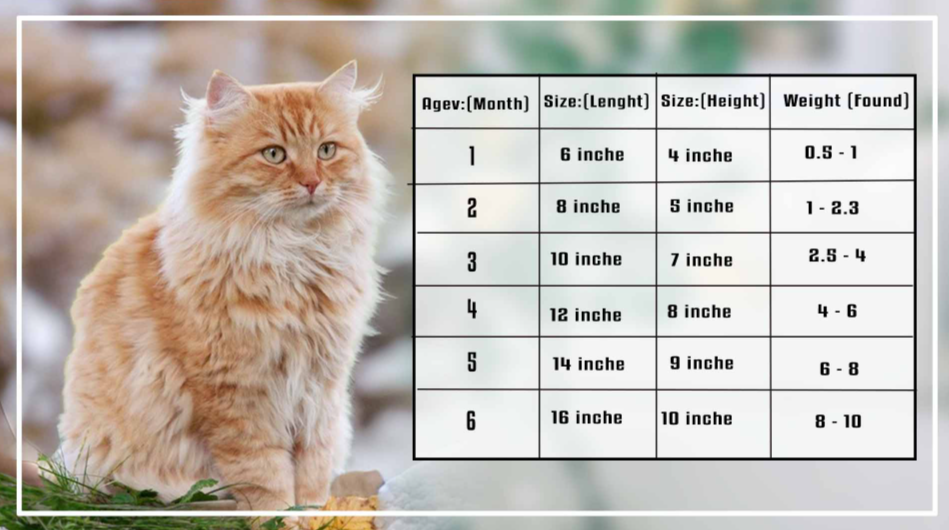

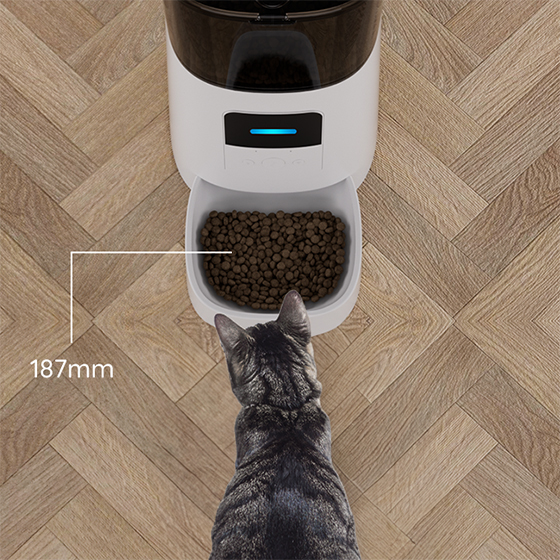

To make informed judgments regarding cat drinks a lot of water, you need to recognize regular water intake for felines first. The daily water consumption for healthy cats should be between 50 to 70 milliliters for each kilogram of their body weight.

The daily water amount for an average cat should measure about one ounce for each pound they carry. A traditional 10-pound cat needs to consume about 10 ounces of water for its daily water intake.

The factors influencing water consumption in cats affect the daily drinking amounts. Dry kibble-eating cats require additional water for hydration since the food product contains little moisture but canned or wet food already provides high water content.

A cat who is active in warm conditions needs to drink a lot of water than a dull indoor cat who prefers resting in cool spaces.

You can detect when a cat’s thirst exceeds normal levels after establishing typical water consumption patterns.

Common Medical Reasons for Increased Thirst

Kidney Disease (Chronic Kidney Disease - CKD)

Chronic kidney disease (CDK) stands as the primary medical cause for a cat drinks a lot of water. This illness mainly affects senior cats while progressing through a long-term period. The kidney functions perform two essential jobs which include waste filtration and maintaining water balance within the body. The kidneys possess a reduced ability to produce appropriate urine concentration when they start breaking down.

The high volume of water loss through urination causes your cat to increase its water consumption. They compensate for this water loss by increasing their water consumption. As their water evaporates from their body they consume more and more fluid.

Other kidney disease indications consist of fatigue and reduced weight alongside appetite decrease and occasional vomiting. Any combination of these signs with excessive thirst in your cat requires an immediate visit to the veterinarian.

Diabetes Mellitus (Sugar Diabetes)

Diabetes mellitus serves as a usual trigger for excessive thirst, and that’s why cat drinks a lot of water. When diabetes mellitus occurs your cat cannot produce enough insulin or correctly process insulin which causes a buildup of sugar in the bloodstream. Umbrellas develop in blood cells due to an elevation of blood sugar.

The excess sugar that enters the urine makes the body carry away additional water when it evacuates from the system. Too much urination because of dehydration drives cats to drink a lot of water.

Diabetic cats may exhibit two distinct symptoms, including elevated appetite during early stages and a depletion of body weight together with occasional hind leg weakness. A diagnosis of diabetes should be considered when your cat excessively drinks water and urinates often yet continues to lose weight. The slow development of diabetes symptoms in cats requires owners to monitor their pets carefully.

Hyperthyroidism

Vertxicoactive thyroid glands lead to Hyperthyroidism being developed. Your cat’s neck contains a small gland that controls metabolism but when it becomes excessively active it accelerates all metabolic functions.

A cat that gains appetite without weight gain might demonstrate restlessness or higher energy levels and elevated heart rate pulses. The high energy consumption by their body could lead a cat drinks a lot of water.

Hyperthyroidism predominately affects elderly cats and doctors can treat this disease yet the neglect of its management leads to severe health complications. Elevated water consumption should trigger you to inspect your cat for thyroid irregularities because these symptoms could indicate thyroid issues.

Urinary Tract Infections (UTIs) and Bladder Issues

UTIs and bladder issues primarily drive cats to increase their urination but these conditions sometimes lead to increased water consumption to help purge the system.

A cat suffering from urinary tract infection displays straining during urination along with higher than normal urination frequency together with red tints in the urine. You can detect these signs with ease when you observe your cat’s restroom habits.

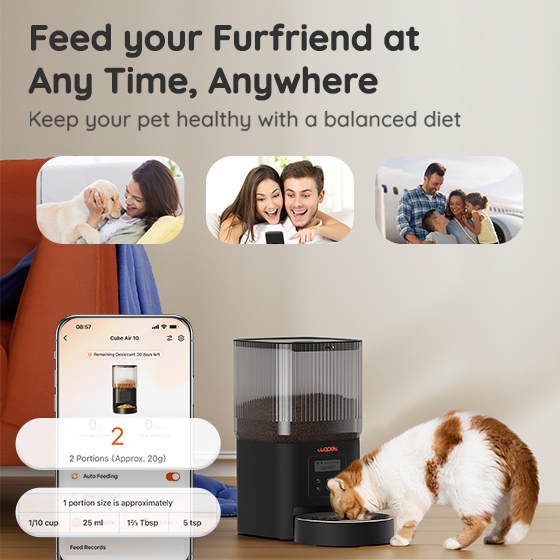

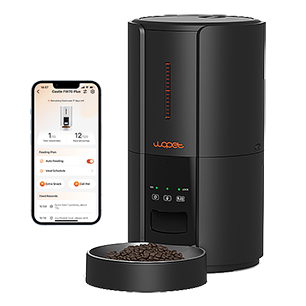

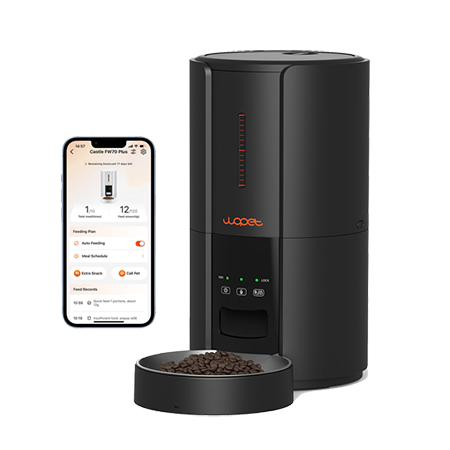

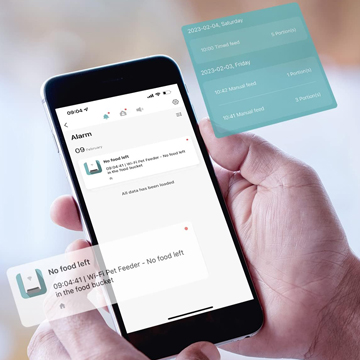

When thirst increases together with other urinary tract symptoms it indicates a potential health problem in this system. A bladder infection in cats shows direct link to their thirst which represents a critical health concern and leads to a cat drinks a lot of water. In such cases, you need to get WOpet’s water fountains for your cat.

Pyometra (In Unspayed Female Cats)

An unspayed female cat may develop the serious condition of uterine infection known as pyometra along with increased thirst. Unspayed older female cats develop this potentially fatal condition that manifests when they reach their seniors.

The main signs besides water intake tendency include weakness, reduced food desire, occasional vomiting, and swollen abdomen. In addition to vaginal discharge some female cats show this medical symptom but not all experience it.

Theft of water by an unsprayed cat requires immediate veterinary intervention especially when you observe excessive thirst. Treatment of Pyometra becomes urgent when surgery stands as the primary choice for medical intervention.

Certain Medications

A cat consuming large amounts of water may signify the side effects of currently taken medication. Excessive thirst as well as increased urination is one of the possible side effects from taking corticosteroid and diuretic medications.

The administration of corticosteroids serves as a treatment for inflammatory diseases and autoimmune problems whereas diuretics help eliminate fluids from within the body. The additional water consumption of your cat warrants a discussion with the veterinarian when they recently began taking medication. The medication side effects may be standard but your veterinarian should assist with uating benefit-vs-side-effect priorities when assessing different treatment options.

Non-Medical Reasons for Increased Thirst

Diet

The natural tendency for cats who eat exclusively dry food is increased water consumption. Dry kibble food has a moisture content that amounts to 10% but wet or canned food contains approximately 70-80% moisture.

Cats are not big water drinkers by nature therefore lower-moisture food leads them to replenish their water requirements from their water bowls. Consistent dietary changes or increased water intake alongside dry food feeding role as primary factors in this case.

The addition of wet food to their meals or the acquisition of a cat water fountain can help increase water intake. The flowing motion of these devices makes water more appealing to cats.

Environmental Factors

The reason behind increased water consumption can occasionally be traced back to environmental factors such as temperatures or recent motions.

Cats naturally consume more fluids when temperatures rise in order to maintain body temperature along with hydration status. A hyperactive cat involved in play activities and running or exploring will require increased fluid consumption.

The high level of water consumption usually lasts only briefly until environmental conditions return to stability.

Your cat requires constant access to fresh water at all times particularly when summer heat arrives and right after energetic physical activities. Hot temperatures have the ability to quietly cause dehydration to develop swiftly.

Behavioral Changes or Stress

A cat that consumes lots of water might possibly react to feeling stressed or anxious but this occurs only in very few instances. Emotional changes in cats can lead to abnormal behaviors through over-grooming or hiding and excessive water consumption.

After experiences such as moving house addition of family pets or changes in their regular activities cats may show this behavior.

Your cat’s excessive water intake might relate to behavioral or stress changes that happen at the same time. Regulating for medical issues remains essential before declaring behavior as the cause of increased thirst symptoms.

Conclusion

Extra water intake in cats should be monitored due to medical risk even though it does not necessarily mean emergency.

The reasons cats need excessive water intake include harmless events such as dry food consumption and warm environmental temperature but serious medical conditions like kidney disease, diabetes, and hyperthyroidism demand medical intervention.

The key is to stay observant. When your cat drinks a lot of water, that is medically known as polydipsia it serves as their method of ing you about a medical issue.

You and your vet can provide proper care to your pet if you respond promptly with their support. The most essential thing is to maintain your cat's health and well-being because that is the core reason for our care. Any time you are doubtful it is wiser to choose safety and have it assessed by a professional.

Resource: 9 Common Reasons Why Your Cat Drinks a Lot of Water

For ages, the story of cats has slunk from mythology into the land of culture and everyday life in Egypt.

In antiquity, cats were revered not merely as pets but as logistical defenders, emblems of the deity, and sympathetic friends.

In ancient times, cats were sacred animals; they were considered more than just pets and as sacred guardians, emblems of the goddess, and loving companions.

British Egyptian cat breeds continue to enthrall their fanciers by merging ancient wonder and fascinating traits in their unique forms. This article mainly focuses on their history, characteristics, and personality.

History and Cultural Importance of Egyptian Cats

About 1500 BC, Egyptian cats first became domesticated (in civilization). Their ancestors were the African wildcats Felis silvestris lybica.

They were the companions, guardians of granaries, and the men against poisonous snakes. The goddess Bastet-mother, usually represented as a lioness or a domestic cat, had apparent protection with fertility and thus made the cat sacred to her.

Mummified cats made their way into tombs bedecked in jewelry to signify their elevated rank.

Almost all modern Egyptian cat breeds trace their ancestry to Egypt because of their ancient history; genetic analyses have proven that all domestic cats, some referred to as Egyptian cat breeds, have common ancestors with the wildcats found in North Africa. Selective breeding concerned pure Egyptians with diverse genetic backgrounds.

European Cat Breeds

1. Egyptian Mau

The Egyptian Mau is the only surviving breed directly linked to the ancient Egyptian civilization." Temple paintings and inscriptions dated before 1550 B.C. show that they were temple pets and resembled modern Egyptian Maus.

The "mau" is a name that has directly come down to us from the ancient Egyptian name for cat. In North America, just after World War 2, Russian Princess Nathalie Troubetskoi imported this breed and began protecting it from potential deterioration.

There are likely around 7,000 registered cats worldwide, including it, some of the rare cat breeds' finest specimens.

They have the following physical characteristics:

● Coat: Short, silky, and spotted; unique among domestic breeds.

● Color: Colors are silver, bronze, smoke, or black.

● Eyes: Gooseberry-green, large, and almond-shaped.

● Build: Medium-sized and muscular, incorporating a flap of skin to the knee.

Egyptian Maus are loyal and fun animals, strongly bonded with only one individual. They are the best athletes among all the cats.

They can run very fast, with a speed covering 30 Mph, and jump to a height of about 6 feet in a single jump. They are very vocal birds, chirping and trilling, and enjoy a good bath.

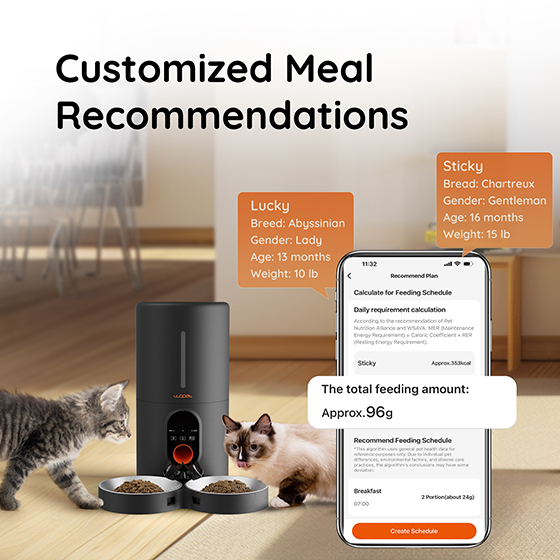

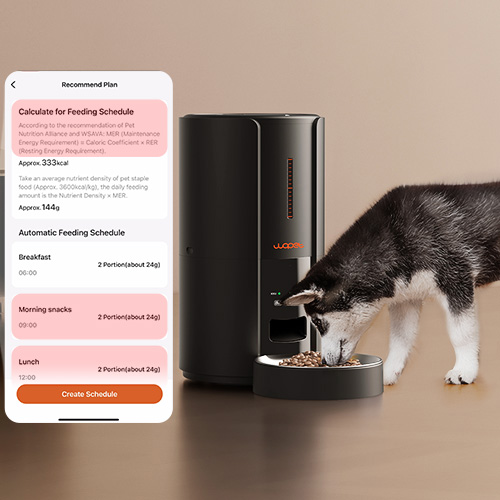

They are very easy to care for; brushing them once a week is plenty. Their diet includes high-protein food to fuel their energy. The Automatic Feeder will help you feed this lively breed. Plenty of tall cat trees and puzzle toys.

They are prone to luxating patellas and some urinary issues; therefore, regular vet check-ups are necessary.

2. Nile Valley Egyptian Cat

Since the breed is that rare Egyptian cat confused with the Mau, we believe it traces its descent directly from the wildcats.

These feral cats reside on the streets of Egypt, their lives threatened by local attempts to eradicate them. The Nile Valley Egyptian Foundation rescues and rehouses them, preserving their name as a "missing link" in the domestication timeline.

They have the following physical characteristics:

● Coat: Short- to semi-long with spotted or marbled patterns.

● Colors: Bronze, black, silver, or smoke.

● Eyes: Amber or green in wild almond shape.

● Build: Slender and athletic, resembling their wild ancestry.

With enough time to get acquainted, they built trust and gave affection. Nile Valley cats are curious and intelligent but shy away from strangers.

They avoid new surroundings to avoid excessive skittishness. They eat Quality kibble supplemented with lean protein. They need weekly brushing using the Self-Cleaning Brush, which can help minimize shedding.

They are doing well, though deworming and immunization will be very important for these rescued cats.

3. Chausie

People have known the large domesticated Mesoamerican cat born in Egypt's jungle as Chausie. They have regarded and even "mummified" these cats as sacred to the ancient Egyptians by having them buried alongside their owners.

The modern Chausie cat is a breed that has existed since the 1990s but was included on TICA's list only this year.

They have the following physical characteristics:

● Fur: Short, harsh, and dense ticked hair banding.

● Colors: Black, brown, or silver tabby.

● Eyes: Ranges from golden to hazel.

● Build: Muscular cats from 15 to 25 pounds with a height of about 19 inches at shoulder level.

Intelligent, fun, and highly interactive, Chausies love to play in the water, and we train them to walk on a leash. They are energetic feline beasts that need entertaining.

They play daily and interact. You can buy toys and accessories for them.

They are most suited to raw or protein-rich feeding that imitates a natural diet.

They play best outdoors or in large indoor spaces.

They have a sensitive stomach, so we suggest grain-free.

Breeds That Are Often Misidentified as Egyptian

1. Abyssinian

They are an alleged association with Egypt. The coat is ticked, the eyes are almond-shaped like those of some ancient art, and the DNA trace shows origins in Southeast Asia. The name comes from Abyssinia, as modern Ethiopia, with a cat named Zula brought in 1868 by British soldiers.

They have the following physical characteristics:

● Personality: Social, playful, and mischievous.

● Care: Regular grooming, provided with mental stimulation.

2. Sphynx

They are also known as the hairless cats. In 1966, a breed developed out of Canada that came to be known as the Egyptian Sphynx, but their hairlessness was no product of a long ancestry. Instead, a mutation caused the breed to be created.

They need the following care tips:

They need weekly bathing to reduce oil buildup. They need to wear sweaters in cold weather.

3. Savannah

They are the modern hybrid. Sauntering between Servals(wild cats traded in ancient Egypt), Savannahs are big Egyptian cat breeds only in looks.

When bred with domestics, early generations (F1-F3) retained wild attributes like bold markings and a love for water.

They need the following care tips:

● Enrichment: Safely secure outdoor areas or a catio.

● Diet: High-protein and low-carbohydrate meals.

How To Care For Egyptian Cat Breeds

Grooming, exercise, and environment are individual requirements of each breed.

The Sphynx needs a bath once a week with a gentle shampoo without hair. It makes oils from the skin come out on the surface. They need bathing to remove that extra oil.

The long-haired Shirazi needs grooming every day to avoid the coat from rolling into knots; else, horror of horrors, matting.

Short-haired spotted Egyptian Mau and Abyssinian cats need brushing lightly once every week to maintain health and minimize shedding. They need space for exercising and interacting with people.

Good playthings for play with all cats and spaces for them must be developed and used exclusively for climbing. Sooner or later, a big hypercar will need more activities for a beautiful character like Chausie or Savannah. You can buy various toys and accessories for them.

The habitats mentioned above, including those of excellent grooming tools, well-balanced nutritious diets, and relatively enriched environments, are required for these beautiful and intelligent beings in the house to maintain good health and a happy life.

Conclusion

Egyptian cat breeds are more than just striking in appearance, they carry history in every graceful step. Whether it’s the quicksilver elegance of the Egyptian Mau or the wild, statuesque beauty of the Chausie, these cats thrive with thoughtful, breed-specific care.

More than affection, they need structure. Balanced nutrition, mental engagement, and a space that respects their energy and intelligence are essential. That’s where the right tools make all the difference.

WOpet helps make that care easier. From automatic feeders that keep mealtimes on track for active breeds like the Savannah, to self-cleaning litter boxes that simplify routines in busy homes, every product is designed to support your cat’s health and happiness. Interactive toys and smart accessories add the enrichment these ancient souls crave.

FAQ Section

1. What are the rarest Egyptian cat breeds?

The Egyptian Mau (7,000 registered) and the Nilotic-Breed Egyptian Cat (feral and rescued) rank first among rare breeds.

2. What is the price range for Egyptian cat breeds?**

The price range for Egyptian cat breeds is as follows:

Mau: $800–$2,500.

Chausie: $1,000–$5,000.

Savannah: Up to $20,000 for F1 hybrids.

3. Did ancient Egyptians have hairless cats?

The hairless cats do not have any ancestral connection with the cats that belonged to Egypt.

Resource: Egyptian Cat Breeds