MM88 la nen tang ca cuoc truc tuyen hang dau chau A, noi bat voi giao dien hien dai, toc do truy cap nhanh va he thong bao mat chuan SSL 256-bit. Nguoi choi co the tham gia vao hang tram sanh cuoc the thao, casino live va slot game dang cap quoc te, mang den trai nghiem giai tri an toan va tron ven nhat. #mm88 #nhacaimm88 #mm888us #nhacaimm888us Website: https://mm888.us/ Dia chi: 10 Le Van A, Thac Mo, Phuoc Long, Binh Phuoc SDT: 0911201111 Email: mm888us@gmail.com Social: https://x.com/mm888us https://www.youtube.com/@mm888us https://www.pinterest.com/mm888us/ https://www.twitch.tv/mm888us https://tumblr.com/mm888us https://gravatar.com/mm888us https://bit.ly/m/mm888us https://jali.me/mm888us https://www.behance.net/mm888us https://linktr.ee/mm888us https://heylink.me/mm888us/ https://linksta.cc/@mm888us https://igli.me/mm888us https://cointr.ee/mm888us https://jaga.link/mm888us https://www.qrcodechimp.com/page/mm888us https://s.id/mm888us

If you’re noticing your car struggling to change gears or a burning smell coming from under the bonnet, it may be time for a clutch replacement Hastings. The clutch is one of the most essential components of your vehicle’s transmission system, and when it begins to wear out, it can seriously affect your driving performance and safety. Fortunately, drivers in Hastings can rely on experienced local mechanics who specialize in professional clutch repair and replacement services to get them back on the road quickly and safely.

Why Clutch Replacement Is Important

Your vehicle’s clutch is responsible for connecting and disconnecting the engine from the transmission, allowing you to shift gears smoothly. Over time, clutch components such as the pressure plate, friction disc, and release bearing can wear out due to constant friction and heat. Ignoring the signs of a faulty clutch can lead to more serious and expensive damage to your gearbox. That’s why regular clutch inspection and replacement are crucial for maintaining your car’s performance and reliability.

When you book a clutch replacement in Hastings, certified technicians will inspect the entire clutch assembly, identify worn parts, and replace them with high-quality OEM or equivalent components. This ensures that your vehicle performs efficiently and delivers smooth gear transitions.

Signs You Need a Clutch Replacement

It’s essential to recognize the warning signs that indicate your clutch may be failing. Some of the most common symptoms include:

Difficulty shifting gears or slipping gears

A spongy or stiff clutch pedal

Grinding noises when changing gears

Poor acceleration despite a rising engine RPM

A burning smell from the engine area

If you notice any of these issues, it’s best to visit a Hastings clutch repair specialist immediately. Early detection can save you from a complete breakdown and more costly repairs later on.

Choosing the Right Clutch Replacement Service in Hastings

When looking for clutch replacement services in Hastings, it’s important to choose a trusted local garage with experienced technicians and modern diagnostic equipment. Reputable workshops offer transparent pricing, use genuine parts, and provide warranties on both parts and labor. Many local mechanics in Hastings also offer same-day service, ensuring minimal disruption to your day.

Before booking, it’s a good idea to read reviews or ask for recommendations to find a reliable clutch repair specialist in Hastings. A well-qualified mechanic can not only replace your clutch but also check for related transmission issues, ensuring your car runs smoothly and safely.

Conclusion

A well-functioning clutch is essential for safe and efficient driving. If you suspect clutch problems, don’t wait for them to get worse—book a clutch replacement in Hastings with a trusted local garage today. With professional service, quality parts, and expert advice, you’ll restore your vehicle’s performance and enjoy a smoother driving experience for years to come.

방콕은 낮과 밤 모두 매력적인 도시입니다. 낮에는 사원, 박물관, 쇼핑을 즐기고, 밤에는 마사지와 합법적인 문화 체험을 통해 여행의 즐거움을 더할 수 있습니다. 특히 여행자 사이에서 자주 언급되는 키워드인 “방콕변마”와 “방콕유흥”은 안전하고 즐거운 밤문화 체험을 의미할 때도 있으며, 여행 계획에 참고하면 좋습니다.

프리미엄 마사지와 휴식

방콕의 마사지 체험은 여행에서 빼놓을 수 없는 즐거움입니다. 전통 타이 마사지, 아로마 마사지, 발 마사지 등 다양한 선택지가 있으며, 프라이빗 스파에서는 조용하고 편안한 환경에서 전문 테라피스트의 맞춤 서비스를 받을 수 있습니다 방콕변마.

방콕변마 라는 키워드는 마사지 체험과 관련된 이야기에서 등장하기도 하는데, 합법적인 마사지샵을 선택하면 안전하게 여행 피로를 풀 수 있습니다. 마사지 후에는 몸이 가벼워지고, 여행 일정에도 활력을 더해줍니다.

안전하게 즐기는 방콕유흥

방콕의 밤문화는 루프탑 바, 재즈 카페, 야시장 등 합법적인 공간에서 즐기는 것이 가장 안전합니다. “방콕유흥”이라는 키워드는 밤문화 전반을 아우르는 표현으로 사용되며, 여행자가 현지 문화를 경험하며 여유를 느낄 수 있는 기회를 제공합니다.

야경을 즐기며 현지 음료와 음식을 체험하거나, 라이브 공연을 관람하는 것만으로도 방콕의 밤을 충분히 즐길 수 있습니다. 안전한 공간을 중심으로 계획하면 여행의 만족도와 편안함을 동시에 높일 수 있습니다.

낮과 밤을 연결하는 여행 루틴

방콕 여행을 효과적으로 즐기려면 낮과 밤의 활동을 잘 연결하는 것이 중요합니다. 오전에는 사원과 박물관을 둘러보고, 오후에는 카페와 쇼핑으로 여유를 즐깁니다.

저녁에는 프리미엄 마사지로 휴식을 취하고, 밤에는 루프탑 바나 야시장에서 여유로운 시간을 보내면 하루를 완벽하게 마무리할 수 있습니다. 이런 루틴을 따르면 여행 중 피로를 최소화하면서도 방콕의 다양한 매력을 충분히 체험할 수 있습니다.

결론

방콕은 낮과 밤 모두 즐길 거리가 풍부한 도시입니다. “방콕변마”와 “방콕유흥”을 안전하고 합법적인 체험 중심으로 즐기면 여행의 즐거움과 휴식을 동시에 누릴 수 있습니다. 여행 계획을 잘 세우고 안전을 최우선으로 하면, 방콕에서의 하루하루가 특별한 추억으로 남을 것입니다.

<!-- wp:paragraph -->

提到 ysl 包 或 ysl 錢包,許多人第一時間聯想到的就是那個標誌性的「yves saint laurent monogram 金標 logo」。這個金色字母象徵著巴黎的時尚靈魂與精緻態度,從經典的肩背包到長夾、卡夾,每一件單品都散發出優雅與力量的平衡。

<!-- /wp:paragraph --><!-- wp:image {"id":4642,"width":"427px","height":"auto","sizeSlug":"large","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

近年來,ysl 皮夾官網 上的商品種類愈加多元,不論是女款長夾、男款短夾還是卡夾,都以極簡線條搭配高質感皮革製成,展現出品牌一貫的高級氣息。特別是這款 YSL Saint Laurent Monogram 金標LOGO粒面壓紋皮革拉鏈錢包 長款皮夾 女款 黑色,以粒面壓紋皮革打造,手感細膩、耐刮實用,搭配經典金色 ysl 字母徽章,無論放入包中或單獨拿在手上都顯得氣場十足。

<!-- /wp:paragraph --><!-- wp:paragraph -->

對於熱愛法式時尚的消費者來說,這款皮夾兼具實用與收藏價值。其內部夾層設計完善,可收納多張卡片與現金,拉鏈款式更確保安全性與便利性。搭配一只 ysl 包,無論是日常通勤或正式場合,都能完整體現品牌的摩登風格。

<!-- /wp:paragraph --><!-- wp:image {"id":4643,"width":"428px","height":"auto","sizeSlug":"large","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

而在男性配件中,ysl 皮夾官網 系列則以簡約俐落的造型為主,去除過多裝飾,取而代之的是細緻皮革與精準縫線。品牌強調“低調奢華”的設計語彙,使這些皮夾在細節中展現高貴質感,是許多男士在尋找質感皮夾時的首選。

<!-- /wp:paragraph --><!-- wp:paragraph -->

對於喜愛輕便風格的消費者,ysl 卡夾 也是極佳選擇。品牌卡夾設計薄巧卻能容納多張卡片,搭配金屬 monogram 標誌,不僅展現時尚態度,也體現對生活品質的講究。

<!-- /wp:paragraph --><!-- wp:paragraph -->

綜合來看,ysl 皮夾男 不僅象徵法式優雅,更是現代女性與男性不可或缺的時尚單品。每一件作品都訴說著 Saint Laurent 對細節與工藝的極致追求,無論作為自用或禮贈,都能留下深刻印象。

<!-- /wp:paragraph --><!-- wp:image {"id":4644,"width":"431px","height":"auto","sizeSlug":"large","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

若你正計畫入手 YSL 的配件,不妨延伸閱讀另一篇推薦文:《YSL 官網必買推薦|Cassandra 牛皮腰帶、YSL 皮帶與零錢包全解析》,深入了解更多經典單品,從腰帶到零錢包,讓你的巴黎風格更加完整。

<!-- /wp:paragraph --><!-- wp:paragraph -->

ysl

ysl 包包

聖羅蘭

saint laurent

ysl 包

ysl 包包官網

ysl 官網

ysl 專櫃

ysl bags

ysl 包包官網台灣

ysl 官網台灣

ysl 門市

yves saint laurent

ysl 斜背包

ysl 肩背包

ysl 側背包

syl

ysl 手提包

ysl 手提袋

ysl 相機包

ysl 台灣官網包包

ysl 後背包

ysl 後背包女

ysl 背包

ysl 托特包

ysl 皮夾

ysl 短夾

ysl 長夾

ysl 錢包

ysl 卡夾

ysl 皮夾官網

ysl 皮夾男

ysl 短夾官網

ysl 長夾官網

ysl 三折短夾

ysl 名片夾

ysl 皮帶

ysl 皮帶女

ysl 皮帶男

ysl 零錢包

ysl 腰包

ysl niki baby

ysl niki

niki ysl

ysl baby niki

ysl niki 中號

ysl niki 尺寸

ysl niki 小號

ysl niki bag

ysl niki medium

ysl niki mini

ysl niki 包

ysl sunset

ysl cassandra

cassandra ysl

ysl cassandra medium

ysl kate

ysl kate mini

ysl kate small

ysl loulou

ysl loulou toy

ysl toy loulou

ysl small loulou

ysl kaia

ysl manhattan

ysl manhattan bag

<!-- wp:paragraph -->

relx 5代

悅刻五代

relx 6代

悅刻六代

relx 5代主機

悅刻五代主機

relx 6代主機

悅刻六代主機

relx 5代煙彈

悅刻五代煙彈

relx 6代煙彈

悅刻六代煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 nike zoom x

nike 台中 員 購 店 門市

nike 小 白 鞋

nike 懶 人 鞋

nike 最新 鞋 款

nike 熊貓

nike 男 鞋

nike 聯名

stussy nike

愛 迪 達 慢跑 鞋

350 鞋子

adidas neo

adidas originals samba

adidas shoes

adidas 女 鞋

adidas 籃球 鞋

愛 迪 達 三葉草

愛 迪 達 板鞋

愛 迪 達 門市

gd nike

nike 270

<!-- wp:paragraph -->

在高端時尚界中,celine 以簡約線條與極致質感聞名,其包款、眼鏡與配件系列更展現法式優雅與現代態度的完美融合。無論是經典的 celine bag 還是造型俐落的 celine 太陽眼鏡,都體現出品牌的獨特美學與實穿魅力,成為時尚迷衣櫥中的長青單品。

<!-- /wp:paragraph --><!-- wp:image {"id":4637,"width":"437px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

celine bag:經典與摩登並存的時尚象徵

<!-- /wp:heading --><!-- wp:paragraph -->

celine bag 一直是品牌最具代表性的作品之一,從 Triomphe 凱旋門系列到 Ava 半月包,每一款都散發低調奢華的氣質。設計師以「極簡中的力量」為理念,透過皮革紋理與俐落剪裁,打造出可日常使用又不失精品質感的包款。不論是通勤、約會還是正式場合,celine 包款皆能展現出獨有的優雅氣場。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

celine 太陽眼鏡與眼鏡:時髦必備單品

<!-- /wp:heading --><!-- wp:paragraph -->

除了包款外,celine 太陽眼鏡(celine sunglasses) 同樣受到時尚圈喜愛。特別是這款【4色】CELINE 醋酸纖維TRIOMPHE 06 太陽眼鏡 墨鏡 女款,以經典 Triomphe 凱旋門 logo 為設計亮點,融合流線鏡框與厚板鏡腳設計,呈現剛柔並濟的摩登風格。醋酸纖維材質輕盈耐用,配戴舒適,不論海邊度假或街頭穿搭,都能展現高級時尚氛圍。

<!-- /wp:paragraph --><!-- wp:image {"id":4638,"width":"439px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

此外,celine 眼鏡 系列同樣深受都會女性喜愛。近年推出的 celine dion 鏡框 以俐落幾何線條與柔和配色為特色,完美融合知性與前衛氣質。

<!-- /wp:paragraph --><!-- wp:paragraph -->

celine dion 鏡框不論是文青風鏡框或方形鏡面設計,都讓日常造型更具層次感,是視覺與時尚兼具的完美配件。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

celine 帽子:低調奢華的造型亮點

<!-- /wp:heading --><!-- wp:paragraph -->

若你偏好更具個性風格的配件,celine 帽子 絕對值得入手。品牌帽款多以簡約LOGO、挺版剪裁與中性色調為主,無論搭配洋裝、牛仔外套或針織衫,都能輕鬆營造巴黎式的隨性感。這也是許多時尚博主與名人愛用的造型單品,讓整體穿搭更顯完整與高級。

<!-- /wp:paragraph --><!-- wp:image {"id":4639,"width":"436px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

延伸推薦:celine 包與皮件的細節魅力

<!-- /wp:heading --><!-- wp:paragraph -->

對於想深入了解品牌更多經典設計的讀者,推薦延伸閱讀:《celine 包與皮件推薦|spike 復古小牛皮腰帶與 triomphe 經典設計全解析》,深入探討品牌在皮革工藝與細節設計上的巧思,從包款到腰帶一次掌握 celine 的極簡奢華哲學。

<!-- /wp:paragraph --><!-- wp:paragraph -->

celine哪裡買最便宜

celine 包

celine 包包

celine 官網

celin

celine 中文

celine 台灣

celine bag

celine taiwan

celine 台灣門市

celine 專櫃

celine 皮夾哪裡買最便宜

celine 短夾

celine 錢包

celine 長夾

celine 零錢包

celine 卡夾

celine 皮帶哪裡買最便宜

celine triomphe哪裡買最便宜

celine woc

celine 經典包

celine 斜背包

celine 側背包

celine 肩背包

celine 後背包哪裡買最便宜

celine 背包

celine 背帶

celine 波士頓包哪裡買最便宜

celine 凱旋門

celine 手提包

celine 小包哪裡買最便宜

celine 托特包

凱旋門 celine

celine 凱旋門包

celine 馬鞍包哪裡買最便宜

celine 馬鞍

celine 老花馬鞍包

celine 馬鞍包價格

celine 墨鏡哪裡買最便宜

celine 太陽眼鏡

celine 眼鏡

celine dion 鏡框

celine 帽子哪裡買最便宜

celine 毛帽

celine 水桶包哪裡買最便宜

celine 水桶包價錢

<!-- wp:paragraph -->

relx 5代

悅刻五代

relx 6代

悅刻六代

relx 5代主機

悅刻五代主機

relx 6代主機

悅刻六代主機

relx 5代煙彈

悅刻五代煙彈

relx 6代煙彈

悅刻六代煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 nike zoom x

nike 台中 員 購 店 門市

nike 小 白 鞋

nike 懶 人 鞋

nike 最新 鞋 款

nike 熊貓

nike 男 鞋

nike 聯名

stussy nike

愛 迪 達 慢跑 鞋

350 鞋子

adidas neo

adidas originals samba

adidas shoes

adidas 女 鞋

adidas 籃球 鞋

愛 迪 達 三葉草

愛 迪 達 板鞋

愛 迪 達 門市

gd nike

nike 270

<!-- wp:paragraph -->

作為日本頂級保養品牌之一,資生堂東京櫃官網以「科技美肌」為核心理念,結合創新研發與高品質配方,持續為亞洲肌膚提供最專業的護膚方案。無論是男士護膚系列還是經典洗面乳產品,資生堂始終以穩定品質與高效保養功效受到消費者信賴。近期推出的多款熱銷單品如 男人極致能量賦活露、資生堂淨白洗面乳與 資生堂敏感話題潔膚乳,更在台灣市場掀起話題,成為護膚入門首選。

<!-- /wp:paragraph --><!-- wp:image {"id":2245,"width":"435px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

資生堂東京櫃官網人氣商品推薦

<!-- /wp:heading --><!-- wp:paragraph -->

在資生堂東京櫃官網中,最受矚目的產品之一便是男人極致能量賦活露(Shiseido Men Ultimune Power Infusing Concentrate)。這款針對男性肌膚設計的精華液,融合資生堂獨家 ImuGenerationRED™ 技術,有效強化肌膚防禦力、改善暗沉與疲憊膚況。質地清爽不黏膩,吸收後能明顯感受到肌膚的緊緻與光澤,適合每日早晚使用,讓男性也能輕鬆養出「健康型男肌」。

<!-- /wp:paragraph --><!-- wp:paragraph -->

同樣熱銷的還有 資生堂淨白洗面乳,主打深層清潔與美白雙效功能。其細緻泡沫可有效帶走油脂與髒汙,同時維持肌膚水潤不乾澀,是追求潔淨透亮膚質者的理想選擇。

<!-- /wp:paragraph --><!-- wp:paragraph -->

對於敏感肌族群來說,資生堂敏感話題潔膚乳(Shiseido Senka Perfect Whip Gentle Cleanser)則提供更溫和的清潔體驗,富含氨基酸成分,能穩定膚況、降低刺激,讓肌膚在洗後仍維持柔嫩光滑。

<!-- /wp:paragraph --><!-- wp:image {"id":2246,"width":"435px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

洗面乳推薦與限定組合

<!-- /wp:heading --><!-- wp:paragraph -->

若你正煩惱該如何選擇適合自己的洗面乳,資生堂洗面乳推薦可依膚質劃分:油性肌可選擇「淨白洗面乳」強化清潔力;乾性與敏感肌則建議使用「敏感話題潔膚乳」以達保濕平衡。這兩款都是日常保養不可或缺的基礎單品,搭配後續保濕或精華產品使用,效果更佳。

<!-- /wp:paragraph --><!-- wp:paragraph -->

近期資生堂更推出限時優惠組合——【神級奇蹟露開運組 買145送100】,內含經典明星產品與旅行組,讓你一次體驗資生堂東京櫃的明星系列。不論是自用或送禮,都是高CP值選擇。

<!-- /wp:paragraph --><!-- wp:image {"id":2247,"width":"439px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

全面打造光采肌的東京櫃保養哲學

<!-- /wp:heading --><!-- wp:paragraph -->

資生堂東京櫃不僅注重肌膚修護,更強調從清潔、保濕到防禦的全方位保養概念。無論男女,都能在官網找到專屬自己的護膚解方。若你想進一步了解更多東京櫃明星商品,推薦延伸閱讀:《資生堂東京櫃保養推薦|激能量水凝凍與激能量水乳霜 打造水潤彈亮肌》,深入解析高效保濕系列如何讓肌膚煥發水光光采。

<!-- /wp:paragraph --><!-- wp:paragraph -->

資生堂

shiseido

資生堂國際櫃

資生堂東京櫃

shiseido資生堂

資生堂產品目錄

資生堂官網

資生堂東京櫃官網

資生堂東京櫃線上購物

日本買資生堂會比較便宜嗎

紅妍超導循環眼部精華

極上御藏傳奇霜

極上御藏傳奇眼霜

極上御藏晚霜

NO.1乳霜王能量組

NO.1乳霜王保濕組

NO.1 乳霜王保濕抗痕組

紅色活酵超導奇蹟露

激透光水乳霜

激能量超導循環保濕日霜SPF20

美透白明眸眼霜

紅妍超導循環眼部精華

極上御藏傳奇眼霜

資生堂小紅瓶

資生堂紅妍肌活露

紅妍超導循環肌活露

红妍肌活精华露

資生堂小紅瓶 青春露

紅色活酵超導奇蹟露

資生堂奇蹟露

極上御藏新生奧義精華

極上御藏

極上御藏傳奇眼霜

資生堂極上御藏防禦精華乳

資生堂御藏眼霜

資生堂極上御藏眼唇霜

資生堂-極上御藏珍珠光持妝乳

資生堂 激抗痕亮采緊緻乳

資生堂 激抗痕亮采緊緻露

資生堂激抗痕亮采緊緻霜

資生堂 激抗痕亮 采 緊 緻 精華

激抗痕亮采緊緻眼霜

資生堂百優精純乳霜

百優乳霜王

百優精純乳霜

百優 資生堂

資生堂百優霜

資生堂百優面霜

資生堂東京櫃百優

活妍系列

資生堂活妍淨泉露

資生堂 活妍淨泉露

資生堂全效抗痕亮采賦活露

資生堂全效抗痕亮采賦活乳

資生堂 激透光水乳霜

資生堂 激透光亮白淡斑精華

激 透 光 水乳霜

激 透 光亮 白 淡 斑 精華

激 能量 水 凝凍

資生堂 激能量水乳霜

資生堂激能量水乳霜

資生堂激彈密澎潤眼霜

資生堂激彈密澎澎霜

激彈密系列

新艷陽·夏

資生堂 新艷陽

資生堂洗面乳推薦

資生堂敏感話題潔膚乳

資生堂淨白洗面乳

資生堂男人極致洗面乳

男人極致能量賦活露

資生堂淨白洗面乳

資生堂敏感話題潔膚乳

資生堂洗面乳推薦

<!-- wp:paragraph -->

relx 5代

悅刻五代

relx 6代

悅刻六代

relx 5代主機

悅刻五代主機

relx 6代主機

悅刻六代主機

relx 5代煙彈

悅刻五代煙彈

relx 6代煙彈

悅刻六代煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 nike zoom x

nike 台中 員 購 店 門市

nike 小 白 鞋

nike 懶 人 鞋

nike 最新 鞋 款

nike 熊貓

nike 男 鞋

nike 聯名

stussy nike

愛 迪 達 慢跑 鞋

350 鞋子

adidas neo

adidas originals samba

adidas shoes

adidas 女 鞋

adidas 籃球 鞋

愛 迪 達 三葉草

愛 迪 達 板鞋

愛 迪 達 門市

gd nike

nike 270

<!-- wp:paragraph -->

在台灣電子菸市場中,relx電子菸(悅刻電子菸)以穩定品質、創新設計與多樣化口味,成為許多消費者的首選品牌。從初代到第六代主機,relx 不斷進化,不僅提升吸菸體驗,更以智能化設計與安全技術建立口碑。無論是新手還是老用戶,都能在 relx 官網 上找到最適合的主機與煙彈組合。

<!-- /wp:paragraph --><!-- wp:image {"id":9092,"width":"435px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

relx 主機:設計與性能的完美結合

<!-- /wp:heading --><!-- wp:paragraph -->

relx 主機 relx 煙彈在外觀設計上延續品牌簡約風格,以霧面金屬質感與人體工學握感為主要特色。最新的 relx infinity 2 六代主機具備智慧氣壓感應與多檔功率調節功能,使用者可根據個人喜好選擇「輕柔、平衡、強勁」三段模式。內建高性能電池與Type-C快充設計,30分鐘即可快速充飽,續航力更持久。

<!-- /wp:paragraph --><!-- wp:paragraph -->

六代主機相容於第四代與第五代的煙彈系統,這點對老用戶尤其友善。若你原本持有 relx 4 或 5 代主機,仍可直接使用新版煙彈,無需更換整套設備,節省成本又環保。

<!-- /wp:paragraph --><!-- wp:image {"id":9093,"width":"427px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

relx 煙彈:多樣口味,精緻體驗

<!-- /wp:heading --><!-- wp:paragraph -->

relx 煙彈向來以「真實還原風味」著稱。近期推出的【鐵觀音】 全新現貨悅刻infinity 2六代煙彈(煙彈x1)(通用Relx 4, 5代主機) 更受到眾多茶系愛好者青睞。這款煙彈以鐵觀音茶葉的濃郁香氣為主調,吸入後可感受到淡淡焙火香與回甘茶韻,口感順滑清新,帶來如品茗般的愜意體驗。

<!-- /wp:paragraph --><!-- wp:paragraph -->

此款煙彈採用封閉式結構,確保氣密性與穩定霧化效果,防漏油設計大幅提升使用安全性。此外,它通用 relx 主機,讓使用者可輕鬆升級享受六代口味,而不必更換原有裝置。若你偏好天然茶香風味,這款「鐵觀音煙彈」絕對是值得入手的限定新口味。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

relx 官網購買建議

<!-- /wp:heading --><!-- wp:paragraph -->

為了確保品質與正品保障,建議透過 relx 官網 或台灣授權經銷門市購買。官網不僅能查詢各系列主機與煙彈的相容資訊,還提供會員積分制度與售後保固服務,讓購買更安心。此外,網站也會不定期推出限時優惠與新品預購活動,是入手新品的最佳渠道。

<!-- /wp:paragraph --><!-- wp:image {"id":9094,"width":"434px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

若你想更深入了解不同代數主機的性能差異與熱銷排行,推薦延伸閱讀:《RELX電子菸全解析|5代主機熱銷推薦》,帶你從使用體驗、續航力到煙彈搭配全面了解最適合的選擇,輕鬆找到專屬你的完美口感。

<!-- /wp:paragraph --><!-- wp:paragraph -->

relx電子菸

relx

relx 主機

relx電子菸

relx

relx 主機

relx電子菸

relx

relx 主機

relx電子菸

relx

relx 主機

relx電子菸

relx

relx 主機

<!-- wp:paragraph -->

relx 5代

悅刻五代

relx 6代

悅刻六代

relx 5代主機

悅刻五代主機

relx 6代主機

悅刻六代主機

relx 5代煙彈

悅刻五代煙彈

relx 6代煙彈

悅刻六代煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 nike zoom x

nike 台中 員 購 店 門市

nike 小 白 鞋

nike 懶 人 鞋

nike 最新 鞋 款

nike 熊貓

nike 男 鞋

nike 聯名

stussy nike

愛 迪 達 慢跑 鞋

350 鞋子

adidas neo

adidas originals samba

adidas shoes

adidas 女 鞋

adidas 籃球 鞋

愛 迪 達 三葉草

愛 迪 達 板鞋

愛 迪 達 門市

gd nike

nike 270

<!-- wp:paragraph -->

在高端時尚界中,巴黎世家(balenciaga)始終是個性與奢華的代名詞。從街頭潮流到伸展台風尚,這個來自法國的精品品牌以其前衛設計和極致工藝征服了全球時尚愛好者。近年來,巴黎世家台灣市場表現亮眼,不論是經典的機車包(balenciaga city bag)還是新興的沙漏包(balenciaga hourglass bag),都成為潮人們爭相入手的夢幻單品。

<!-- /wp:paragraph --><!-- wp:image {"id":4631,"width":"434px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:heading {"level":3} -->

巴黎世家機車包:復古與叛逆的時尚象徵

<!-- /wp:heading --><!-- wp:paragraph -->

說到balenciaga 包,最經典的莫過於機車包(巴黎世家機車包)。自2001年問世以來,它以柔軟的羊皮、鉚釘裝飾與復古油蠟質感風靡全球。機車包兼具休閒與高端氣質,不論搭配皮衣或襯衫都能展現獨特態度。

<!-- /wp:paragraph --><!-- wp:paragraph -->

如今,巴黎世家機車包價格依尺寸、材質與限量系列而異,小號款約落在新台幣五萬元上下,而經典大號則約七至八萬元之間。若想購入正品,建議可至巴黎世家台灣專櫃或官網查詢最新款式與售價。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

沙漏包:Balenciaga的新時代經典

<!-- /wp:heading --><!-- wp:paragraph -->

除了機車包外,balenciaga 沙漏包(hourglass bag)是品牌近年最具代表性的造型包款。以弧形下擺與立體結構聞名,宛如沙漏般的外型極具辨識度。最新推出的【專櫃同款#3色】BALENCIAGA巴黎世家CRUSH小號絎縫鏈條包油蠟皮沙漏包更是時尚圈的新寵。此款以柔軟皮革搭配金屬鏈條設計,完美融合摩登與優雅風格。無論搭配洋裝或皮褲,都能瞬間提升整體造型層次。

<!-- /wp:paragraph --><!-- wp:image {"id":4632,"width":"435px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

巴黎世家沙漏包系列的魅力在於它的「可塑性」——包身柔軟,可隨意擠壓出自然皺褶,散發不經意的高級隨性感。三色可選的設計(經典黑、霧灰與裸粉)更滿足不同穿搭風格需求,是不少名人與網紅私下愛用的每日包款之一。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

巴黎世家台灣購包指南

<!-- /wp:heading --><!-- wp:paragraph -->

在機車包巴黎世家購買包款時,建議消費者可透過官方管道入手,包括 balenciaga 官網或百貨專櫃。除了保證真品來源外,也能享有最新系列資訊與售後服務。若偏好稀有配色或限量版本,也可留意各大精品代購平台,但務必確認正品證明與購買保障。

<!-- /wp:paragraph --><!-- wp:image {"id":4633,"width":"436px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

值得一提的是,巴黎世家不只在包款上引領潮流,其服飾系列也深受喜愛。想了解更多品牌穿搭靈感,推薦延伸閱讀:《巴黎世家BALENCIAGA毛衣穿搭推薦》,帶你掌握秋冬街頭時尚的重點造型。

<!-- /wp:paragraph --><!-- wp:paragraph -->

balenciaga哪裡買最便宜?

巴黎世家

巴黎世家官網台灣

巴黎世家官網

balenciaga 官網

balenciaga 台灣官網

balenciaga 台灣

巴黎世家台灣

巴黎世家台灣官網

巴黎世家台灣專櫃

巴黎世家專櫃

balenciaga taiwan

巴黎世家 balenciaga

巴黎世家包包

balenciaga 包

balenciaga 包包

巴黎世家包

巴黎世家機車包哪裡買最便宜?

巴黎世家機車包官網

balenciaga 機車包

機車包巴黎世家

巴黎世家機車包價格

巴黎世家沙漏包

balenciaga 沙漏包

巴黎世家托特包

balenciaga 托特包

巴黎世家相機包

balenciaga 相機包

巴黎世家腰包

balenciaga 腰包

巴黎世家後背包

balenciaga 後背包

balenciaga 背包

巴黎世家皮夾

巴黎世家錢包

balenciaga 皮夾哪裡買最便宜?

巴黎世家短夾

巴黎世家卡夾

巴黎世家長夾

balenciaga 短夾

balenciaga 長夾

balenciaga 三折短夾

巴黎世家男夾

巴黎世家老爹鞋

balenciaga triple s

balenciaga 老爹鞋哪裡買最便宜?

巴黎世家triples

巴黎世家鞋子

balenciaga 鞋子

balenciaga shoes

巴黎世家鞋

balenciaga 鞋

巴黎世家男鞋

巴黎世家鞋官網

巴黎世家女鞋

巴黎世家鞋子價格

巴黎世家襪套鞋

巴黎世家襪鞋

balenciaga 襪套鞋

balenciaga speed trainer

巴黎世家襪子鞋哪裡買最便宜?

balenciaga track

巴黎世家track

balenciaga track 2

巴黎世家運動鞋

track balenciaga

巴黎世家track2

balenciaga runners

balenciaga race runners

grey balenciaga runners

巴黎世家拖鞋

balenciaga 拖鞋

巴黎世家衣服

balenciaga 衣服

巴黎世家衣服男

巴黎世家上衣

balenciaga 衣服價格

巴黎世家帽t

balenciaga 帽t

巴黎世家外套

balenciaga 外套

巴黎世家牛仔外套

巴黎世家羽絨外套

balenciaga 牛仔外套

巴黎世家毛衣

balenciaga 毛衣

巴黎世家襯衫

balenciaga 襯衫

balenciaga shirt

balenciaga t shirt

balenciaga 3xl

巴黎世家t恤

巴黎世家短袖

balenciaga 短袖

巴黎世家tshirt

巴黎世家內褲

balenciaga 內褲

巴黎世家褲子

balenciaga 褲子

<!-- wp:paragraph -->

relx 5代

悅刻五代

relx 6代

悅刻六代

relx 5代主機

悅刻五代主機

relx 6代主機

悅刻六代主機

relx 5代煙彈

悅刻五代煙彈

relx 6代煙彈

悅刻六代煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 nike zoom x

nike 台中 員 購 店 門市

nike 小 白 鞋

nike 懶 人 鞋

nike 最新 鞋 款

nike 熊貓

nike 男 鞋

nike 聯名

stussy nike

愛 迪 達 慢跑 鞋

350 鞋子

adidas neo

adidas originals samba

adidas shoes

adidas 女 鞋

adidas 籃球 鞋

愛 迪 達 三葉草

愛 迪 達 板鞋

愛 迪 達 門市

gd nike

nike 270

<!-- wp:paragraph -->

隨著電子菸市場在台灣日益成熟,relx 電子菸(悅刻電子菸)憑藉其穩定的品質與創新的吸煙體驗,逐漸成為年輕族群與老菸槍轉換首選。不論是想體驗多樣口味煙彈,還是尋找高品質主機裝置,悅刻官網(relx 官網)與各地的悅刻門市都能輕鬆滿足需求。

<!-- /wp:paragraph --><!-- wp:image {"id":9087,"width":"428px","height":"auto","sizeSlug":"large","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

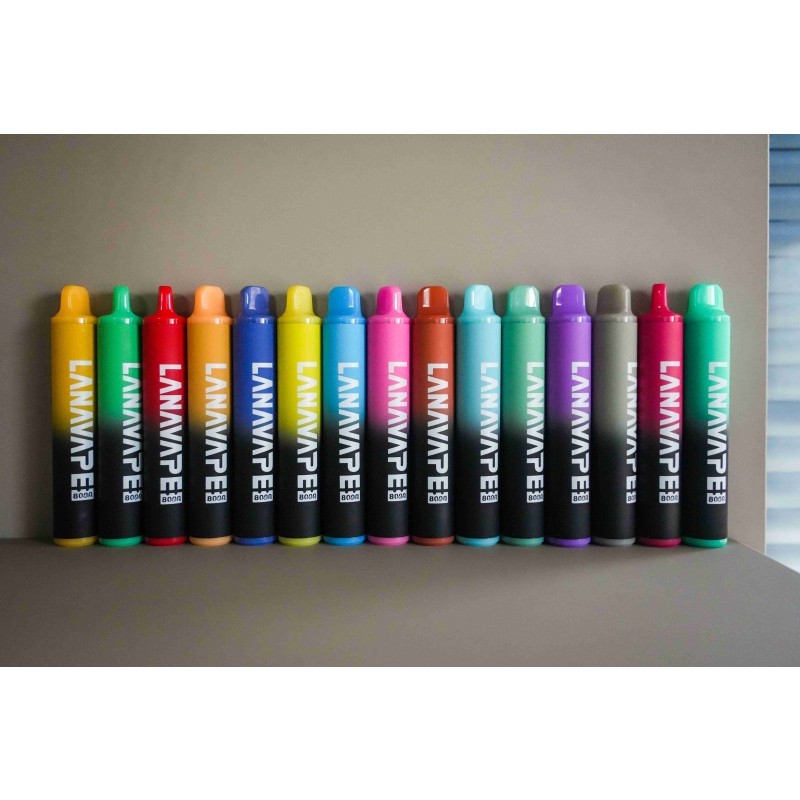

在眾多品牌中,LANA 拋棄式電子煙以「超大容量、即拆即吸」的特點脫穎而出。這款【5000口 LANA 大容量拋棄式電子煙】在台灣市場極具人氣,主打「原裝正品、台灣現貨」的保證,無需加油、無需充電,使用完畢即可丟棄,讓使用過程更加便利衛生。對於不想長期維護設備的用戶來說,這是一款兼具時尚與實用的入門選擇。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

relx 電子菸的魅力與優勢

<!-- /wp:heading --><!-- wp:paragraph -->

悅刻電子菸最吸引人的地方在於穩定的氣霧輸出與高品質的煙彈設計。從一代至六代,relx 每次推出的新款都優化了吸阻、口感與電池續航力。以最新一代主機為例,除了搭載智能氣壓感應系統外,還支援磁吸式煙彈設計,使更換更快速安全。

<!-- /wp:paragraph --><!-- wp:paragraph -->

另外,悅刻官網也不斷更新口味系列,從清新薄荷、冰鎮葡萄到奶香系列,選擇多樣,適合不同吸菸習慣與口味偏好。

<!-- /wp:paragraph --><!-- wp:image {"id":9088,"width":"433px","height":"auto","sizeSlug":"large","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

對於想要入手正品的消費者,建議可直接透過 relx 官網或悅刻門市購買,避免購買到非原廠煙彈,影響吸菸體驗與安全性。

<!-- /wp:paragraph --><!-- wp:heading {"level":3} -->

LANA 拋棄式電子煙:便捷新選擇

<!-- /wp:heading --><!-- wp:paragraph -->

相較於需搭配主機與煙彈的系統式電子菸,【5000口】LANA大容量/拋棄式電子煙/台灣現貨原裝正品以其「開盒即用」的特性受到市場熱烈歡迎。一次可吸約5000口,搭配穩定的電池與高濃度尼古丁鹽,滿足長時間使用需求。其多變的口味如青蘋果冰、芒果冰、蜜桃烏龍等,不僅氣味濃郁,還能提供順滑喉感,深受電子菸愛好者喜愛。

<!-- /wp:paragraph --><!-- wp:paragraph -->

悅刻門市,若你偏好靈活可替換煙彈的設計,relx 電子菸會是更長期的投資;而若你重視便捷與即用性,LANA 拋棄式電子煙則更適合短期或外出使用。

<!-- /wp:paragraph --><!-- wp:image {"id":9089,"width":"438px","height":"auto","sizeSlug":"full","linkDestination":"none"} -->

<!-- /wp:image -->

<!-- /wp:image -->

<!-- wp:paragraph -->

若你想更全面了解如何選購主機與煙彈,推薦延伸閱讀:《Relx電子菸全解析:悅刻主機與煙彈選購指南》,讓你在入手前掌握最實用的比較資訊,挑選出最適合自己的電子菸組合。

<!-- /wp:paragraph --><!-- wp:paragraph -->

relx 電子菸

悅刻電子菸

悅刻官網

relx 官網

悅刻門市

relx 電子菸

悅刻電子菸

悅刻官網

relx 官網

悅刻門市

relx 電子菸

悅刻電子菸

悅刻官網

relx 官網

悅刻門市

relx 電子菸

悅刻電子菸

悅刻官網

relx 官網

悅刻門市

relx 電子菸

悅刻電子菸

悅刻官網

relx 官網

悅刻門市

<!-- wp:paragraph -->

relx 5代

悅刻五代

relx 6代

悅刻六代

relx 5代主機

悅刻五代主機

relx 6代主機

悅刻六代主機

relx 5代煙彈

悅刻五代煙彈

relx 6代煙彈

悅刻六代煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 電子菸

悅刻電子菸

relx

悅刻

悅刻煙彈

relx 煙彈

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 煙彈口味推薦

relx 煙彈哪裡買

悅刻煙彈口味

relx 煙彈購買

relx 煙彈台灣

relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 relx 電子菸 悅刻主機 relx relx 主機 悅刻 悅刻電子菸 nike zoom x

nike 台中 員 購 店 門市

nike 小 白 鞋

nike 懶 人 鞋

nike 最新 鞋 款

nike 熊貓

nike 男 鞋

nike 聯名

stussy nike

愛 迪 達 慢跑 鞋

350 鞋子

adidas neo

adidas originals samba

adidas shoes

adidas 女 鞋

adidas 籃球 鞋

愛 迪 達 三葉草

愛 迪 達 板鞋

愛 迪 達 門市

gd nike

nike 270

In the dynamic landscape of online gaming, the HARGATOTO platform has carved a prominent niche as a modern hub for both Bandar Toto 4D enthusiasts and slot game players. Recognized for its reliability, innovative features, and seamless user experience, HARGATOTO has quickly become one of the most popular gaming platforms in Asia. This article delves deep into what makes HARGATOTO a standout choice for players seeking excitement, convenience, and a trustworthy environment.

Modern Bandar Toto 4D: A Game of Strategy and Luck

Bandar Toto 4D is a classic lottery game widely adored across Asia. It combines elements of chance, strategy, and anticipation, offering players the thrill of potentially winning significant prizes. Unlike traditional lottery systems, HARGATOTO’s modern Bandar Toto 4D interface is designed for simplicity and accessibility. Players can effortlessly place bets, check results, and track their numbers in real-time.

One of the key advantages of situs slot system is its transparent result system. Every draw is conducted fairly, with outcomes displayed instantly on the platform. This transparency fosters trust among players, encouraging more engagement and repeated play. Additionally, the platform supports multiple types of bets, catering to both casual players and seasoned gamblers seeking a more strategic experience.

Situs Slot Gacor: Redefining Online Slot Experiences

Beyond lottery games, HARGATOTO is celebrated for its Situs Slot Gacor, a term used in the gaming community to describe slot machines with higher payout rates. These slots are specifically curated to offer a more rewarding experience while maintaining fairness and excitement.

The platform hosts a diverse collection of slot games, ranging from traditional three-reel machines to modern video slots with immersive graphics and themes. Players can enjoy various genres, including adventure, mythology, and fantasy, ensuring that every gaming session feels fresh and engaging. The Gacor slots at HARGATOTO are optimized for mobile and desktop play, providing smooth gameplay, fast loading times, and interactive features like bonus rounds and free spins.

User-Friendly Interface and Seamless Experience

HARGATOTO’s design philosophy revolves around user convenience and accessibility. The platform employs a clean, intuitive layout that makes navigation effortless, even for newcomers. From registration to depositing funds, placing bets, and withdrawing winnings, every step is simplified to minimize confusion and maximize enjoyment.

A standout feature is the real-time statistics and results tracking. Players can monitor their performance, review past bets, and analyze trends to refine their strategies. This data-driven approach appeals to both casual users and serious players who want to improve their odds and enjoy a more engaging gaming experience.

Security and Trust: Cornerstones of HARGATOTO

In the world of online gambling, security and trust are paramount. HARGATOTO employs advanced encryption protocols to safeguard user data and financial transactions. Players can deposit and withdraw funds with confidence, knowing that their sensitive information is protected.

Moreover, the platform ensures fair play through certified random number generators (RNGs). Every draw in Bandar Toto 4D and every spin on the slot machines is independently verified to prevent manipulation and guarantee fairness. This commitment to integrity has earned HARGATOTO a strong reputation among the Asian gaming community, making it a preferred choice for players who value both excitement and safety.

Bonuses, Promotions, and Loyalty Programs

HARGATOTO goes beyond offering standard games by providing a wide array of bonuses and promotional incentives. New players are welcomed with attractive sign-up bonuses, while regular users can benefit from cashback offers, free spins, and seasonal promotions.

The platform also features a loyalty program that rewards consistent players with exclusive perks. Points accumulated through regular gameplay can be exchanged for bonuses, merchandise, or even direct cash rewards. This gamified approach enhances user engagement and encourages a long-term connection with the platform.

Mobile Optimization: Gaming on the Go

In today’s fast-paced digital era, mobile accessibility is essential. HARGATOTO ensures that both Bandar Toto 4D and Gacor slot games are fully optimized for smartphones and tablets. Players can enjoy seamless gameplay anywhere, anytime, without compromising on graphics quality or interactive features.

The mobile interface mirrors the desktop experience, maintaining clarity and functionality. With responsive design and lightweight performance, HARGATOTO makes it convenient for users to place bets, track results, and explore new games on the go.

Community Engagement and Customer Support

A significant factor contributing to HARGATOTO’s popularity is its focus on community engagement. The platform maintains an active presence across social media channels, forums, and messaging apps, fostering a vibrant community where players can share experiences, tips, and insights.

Additionally, 24/7 customer support ensures that users receive timely assistance for any queries or technical issues. Whether it’s troubleshooting a transaction, understanding game rules, or resolving account concerns, HARGATOTO’s dedicated support team provides prompt and professional help.

The Future of HARGATOTO

As the Asian gaming market continues to grow, HARGATOTO is well-positioned to expand its offerings and technological innovations. Plans for integrating live dealer games, virtual reality slots, and AI-driven recommendations are already on the horizon. These developments promise to enhance user engagement, elevate gameplay, and set new standards for online gaming platforms in Asia.

Moreover, the platform is exploring partnerships with other reputable gaming providers to diversify its portfolio and ensure that players have access to the latest and most exciting games. By staying ahead of trends and focusing on user satisfaction, HARGATOTO is likely to remain a leader in the online gambling industry for years to come.

Conclusion

The HARGATOTO platform represents the perfect blend of modern technology, security, and entertainment for Bandar Toto 4D and slot game enthusiasts. Its commitment to fairness, seamless user experience, and engaging gameplay has earned it a reputation as one of the most trusted and popular gaming platforms in Asia.

From Gacor slot machines with higher payout rates to transparent and strategic Bandar Toto 4D games, HARGATOTO caters to a wide audience of gamers. Coupled with responsive customer support, mobile optimization, and rewarding loyalty programs, the platform ensures that every player enjoys a safe, thrilling, and satisfying gaming experience.

For those seeking a reliable and entertaining online gaming destination, HARGATOTO is more than just a platform—it’s a community, a strategy hub, and a source of endless excitement in the evolving world of Asian online gambling.